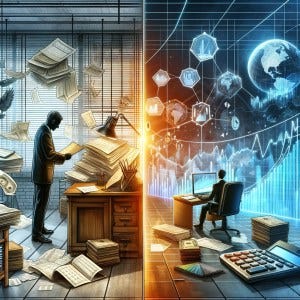

Accounting versus Finance

Exploring the Distinct Roles of Accounting and Finance in Small to Medium-Sized Businesses

Understanding the distinction between accounting and finance functions is crucial for efficient business management and planning. Although these areas are often intertwined and sometimes managed by the same department in smaller organizations, they serve distinct purposes and require different skill sets and focuses. I’ve been there.

The Accounting Function: Recording and Reporting Financial History

Accounting is often described as the language of business. In SMBs, the accounting function primarily deals with the systematic recording, analyzing, and reporting of financial transactions. This process involves:

Bookkeeping: The foundational aspect of accounting, bookkeeping involves the daily recording of financial transactions, ensuring accuracy and completeness. With today’s technology, much of this can be automated.

Financial Reporting: Accountants prepare financial statements like the balance sheet, income statement, and cash flow statement, which offer insights into the company’s financial health.

Compliance and Regulation: Accountants ensure adherence to financial regulations and standards, such as GAAP (Generally Accepted Accounting Principles).

Taxation: Managing and preparing tax returns and ensuring compliance with tax laws is a critical part of the accounting role in SMBs.

Accounting’s primary focus is historical; it’s about accurately recording past financial activities to provide a clear picture of where the company has been. This is crucial in helping an SMB to understand what has happened so they can better plan and prepare for the future.

The Finance Function: Planning and Managing Future Financial Performance

In contrast, the finance function is much more forward-looking and strategic. It’s about planning for the future and managing the organization’s financial resources to achieve its goals. Key activities include:

Financial Planning and Analysis (FP&A): This involves budgeting, forecasting future earnings, and analyzing financial trends to inform strategic decisions.

Investment and Capital Management: Finance professionals assess investment opportunities and manage capital allocation to ensure optimal returns and financial health.

Risk Management: Identifying and mitigating financial risks is a key aspect of the finance role.

Fundraising and Capital Structure: In SMBs, the finance function often includes securing funding (loans, equity, etc.) and managing the company’s debt-to-equity ratio.

Finance focuses on the future, using historical data as a guide but primarily looking forward to drive business growth and stability.

Synergy and Distinction

While accounting provides the factual basis of a company’s financial situation, finance uses this data to plan, project, and strategize. In SMBs, the line between these two functions can blur, especially in organizations with limited resources. However, recognizing the distinct roles each play is important for a balanced approach to financial management.

In summary, accounting and finance are two pillars of financial management in SMBs, each with its unique focus and function. Accounting looks back to ensure accurate recording and compliance, while finance looks forward to drive growth and stability. Understanding and effectively managing both aspects are key to the success of any small to medium-sized business. Tyche Advisors can help your business in both areas. Contact us to see how we can help.